Charting progress: EVs and the road to peak oil

As electric vehicle (“EV”) adoption grows, consumption of gasoline and diesel fuels will decrease. This decreased dependence on fossil fuels is known as oil displacement, and by understanding its impact to date we can hone our strategy to accelerate electrification.

Welcome to Charting Progress, a new Drive Electric Campaign series focused on infographics and insights. Each post, we’ll feature a new chart and dive into how the data connects with the work of our partner network to accelerate a fully electric transportation future.

Every 30 seconds, global road transportation is responsible for the use of an Olympic-sized swimming pool full of oil. This represents nearly 50% of total oil demand, and because oil (and its derivative, gasoline) is a fossil fuel and is one of the largest contributors to global climate change, this drives a direct link between our modes of transportation and the worsening effects of the climate crisis.

What is oil displacement, and why does it matter?

Fortunately, as electric vehicle (“EV”) adoption grows, consumption of gasoline and diesel fuels will decrease. This decreased dependence on fossil fuels is known as oil displacement and represents a tangible yet invisible benefit of the shift to zero-emission transportation. Even when accounting for the impact of manufacturing, EVs today have a dramatically lower carbon footprint over the span of the vehicle’s life, when compared to combustion vehicles that are fueled with gas, petrol, diesel, and even so-called “e-fuels.” Although EVs are still a small portion of global vehicles on the road, when we look at oil displacement we can see the promise of a positive climate impact beginning to take off.

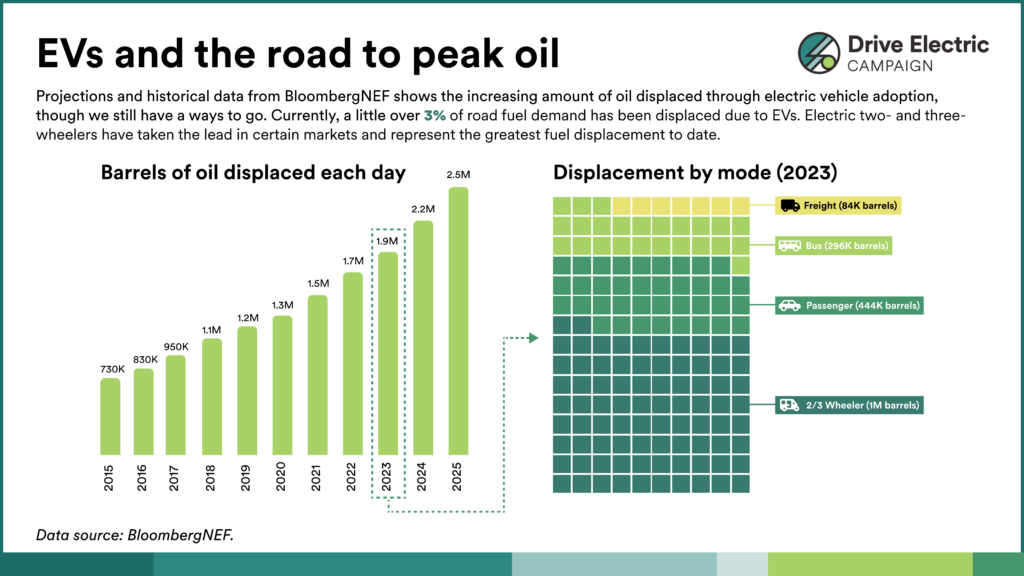

Today, EVs of all kinds are already displacing an estimated 1.9M barrels of oil per day in 2023, according to BloombergNEF’s EV Outlook report. Additionally, the report highlights the impact that EV adoption has made in reducing our dependence on oil as road fuel. Here are key takeaways:

Fuel demand for road vehicles is expected to peak in 2027

Oil displacement is expected to increase significantly in the near future, and oil demand for transportation has already peaked in the U.S. and Europe, while demand in China is expected to peak in 2024. The decline in oil demand in these regions can be attributed to influential policies, such as the new CO2 standards in Europe and NEV subsidy scheme in China, which have promoted the sales of EVs over traditional internal combustion engine vehicles (download our latest report, Driving Progress, for more on these key policies). A recent article from the New York Times notes that oil demand is expected to drop in the next five years “as a shift to electric vehicles and other cleaner technologies brings growth in global oil use almost to a complete halt,” highlighting research from the International Energy Agency that mirrors BloombergNEF’s forecasts.

Different vehicles are on different tracks

When we look at oil displacement by vehicle mode, two- and three-wheelers make up more than half of the total volume. Globally, oil demand for two- and three-wheelers and buses has already peaked, and demand from passenger cars is now expected to peak in 2025. But these changes are not evenly dispersed around the globe – in fact, electric two- and three-wheelers are so widely adopted in China that this early and vast fleet transition skews the global picture. In many parts of the world, much more policy support and financing is needed to align with the global peak oil estimates: for example, Drive Electric Campaign partner ITDP has published a report with recommendations on how Indonesia can meet its goal of reaching more than 2 million electric two-wheelers by 2025, while the ZEBRA initiative, supported by Campaign partners C40 Cities and ICCT, has mobilized more than 4,100 electric buses across South America to help speed the shift to clean mobility.

Lastly, let’s look at trucks, which currently make up the smallest portion of total oil displacement. Yet globally, medium- and heavy-duty trucks account for approximately 36% of on-road oil consumption, according to Drive Electric partner CALSTART. Even though the technology is available today, and a growing number of countries are committed to 100% clean trucks by 2040, more momentum is needed to spur the transition. Similar to two- and three-wheelers, most of the world’s zero-emission trucks are currently on the road in China (see Fig. 6 in our progress report for more details). A wave of policy-making opportunities in the U.S. and Europe, and promising benefits in India, could accelerate electric truck adoption, but the transition timeline will still likely take longer to materialize in the oil displacement data.

Speeding up to meet climate goals

While it’s exciting to be on the precipice of peak oil, electric vehicle adoption still needs to accelerate to align with pathways for a 1.5°C compatible future. Our shared goal for the Drive Electric Campaign is for all new vehicle sales to be 100% zero-emission by 2050; the latest report by ClimateWorks’ Global Intelligence division, “Achieving global climate goals by 2050,” digs deeper with open source climate modeling to illustrate the importance of meeting this target.